Tokenization

Lee & Bronski attempts to offer Clients a chance to enter the real estate markets with so called “fractionalized investments”.

Our objective is to tokenize properties to provide a variety of benefits to our retail investors such as:

- Global access

- Instant entering an investment position

- Token buy-back by Lee & Bronski for the reselling purpose

- Instant settlement via whitelisted peer-to-peer transactions

- Minimized transaction fees

- Yield earning based on the tokenized shares of properties being rented, sold or renovated

- Decreasing the risk by diversifying real estate portfolio in different regions and types (residential, industrial, commercial)

Definitions

Tokenization is a rapidly developing area in the financial industry which enables investment in the form of digital tokens backed by real world securities or assets. For the purposes of this paper, “tokenization” will be used as a general description of the process of moving traditional non-digital securities to a digital form using blockchain technology. “Tokenized securities” will be used to describe digital investment products with the characteristics and functions of securities. “Security tokens” will be used to describe the form in which tokenized securities are issued to investors.

At the core of tokenization is blockchain technology, a type of distributed ledger which secures identical copies of data across a network of authorized stakeholders. In contrast to a centralized database, there is no single point of failure for data stored on blockchain, and unauthorized access to or alteration of data is near impossible. Leveraging the secure, immutable qualities of blockchain technology, tokenization facilitates digital fractional ownership with secure transaction records and swift settlement processes.

Tokenization is quickly gaining traction in the real estate sector, and traditional real estate institutions are partnering with technology providers to explore the tokenization of debt or equity. As more and more technology-backed real estate projects come to fruition, we expect that real estate investment will be invigorated by increased investor access to quality property assets. Technology providers will in turn benefit from quality asset origination as well as the financial expertise of an expanding network of traditional real estate stakeholders.

General benefits of tokenization

Fractionalization

For assets that traditionally have large upfront capital requirements, tokenization lowers the barriers to entry for investment by enabling interests in the asset to be more readily divided across a wider pool of investors, democratizing access to the asset. Fractional ownership is securely managed by a digital register of members (ROM) on blockchain. New financial products could be distributed to a wider pool of investors at a lower per unit cost, with a fee structure inclusive of an access premium for the previously inaccessible investment opportunity.

Operational Efficiency

Smart contracts are programmable actions on the blockchain that facilitate the automation of processes such as compliance checks, investor whitelisting, and post-issuance matters including dividend distribution. Smart contracts also enable the programming of tokens with unique qualities, such that characteristics of each share class and customizable fee structures could be created for tokenized assets at a relatively low operational cost.

Reduced Settlement Time

Transactions in tokenized products can be settled almost instantly, unlike the days or weeks that it can sometimes take to settle traditional finance transactions.

Data Transparency

Blockchain as a distributed ledger technology is known for its immutability and resistance to cyber-attacks, as data is distributed across a network of participating nodes as opposed to a single centralized database. While transaction information is made trackable and visible on blockchain, data anonymity of blockchain transactions are preserved by cryptographic hashes.

Flexibility

The above elements enable flexibility in investment: fractionalization enables flexible portfolio construction and diversification; operational efficiency and reduced settlement time allows faster transfer of investment interests; and data transparency brings updated information for investment analysis.

Liquidity

Tokenization enables liquidity by enabling the secure transfer of shares between investors, with every transaction reflected on the digital ROM. With regulatory regimes worldwide embracing, and establishing frameworks for the regulation of, digital securities exchanges, global public market liquidity for tokenized securities is also well on its way.

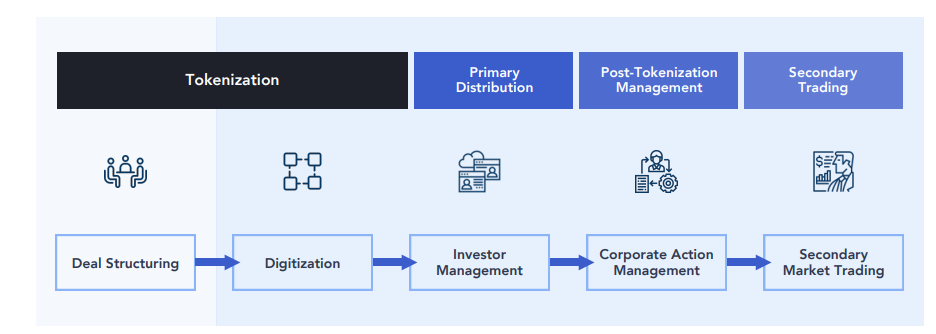

Lifecycle of a tokenized security

The lifecycle of a tokenized security can broadly be divided into 5 stages.

01 In the initial deal structuring stage, crucial decisions need to be made regarding the terms and conditions of the security token. Deal structuring is an integral part of any securities offering, irrespective of the technology employed. Tokenization is not meant to be a way of avoiding compliance with applicable legal and regulatory requirements; rather, the use of technology is intended to fundamentally improve operational processes to enable innovative financial solutions. The stages in the diagram shaded in blue are where technology can bring significant benefits.

02 The digitization stage is where information traditionally stored in paper or document form is uploaded to the blockchain and coded in smart contracts, and security tokens are issued.

03 Primary distribution is the process where tokens are distributed to investors in exchange for investment capital, and the investors’ information is recorded on the digital ROM.

04 Post-tokenization management involves corporate action management processes including dividend distribution and shareholder voting, many of which can be automated by smart contracts coded on the token. Post-tokenization management will continue throughout the life of the token until maturity or redemption.

05 The final stage, and where the value of tokenization in enhancing liquidity is realized, is secondary trading. This is where a token holder can trade tokens with another investor in an over-the-counter arrangement or on an exchange.

Phase 1: deal structuring

Security tokens are typically issued by an entity, corporate or an individual, and provide the token holder specified rights such as ownership, repayment of a specific sum of money, or entitlement to a share in future profits. The form and structure of a tokenized security is crucial in determining the rights and obligations that the investor has in the underlying asset as well as ultimately what form of return they will receive; it will also be the starting point in analyzing how gains and losses on the tokenized security should be taxed. Furthermore, tokenization could affect the valuation process, which may in turn affect the trading price of the security token. As tokenization is still a relatively new space, analysis of the above issues must be undertaken on a case-by-case basis. However, this may well change in the future as transaction data of tokenized securities accumulates for institutional analysis.

Securities that are structured differently benefit from tokenization in different ways. Asset owners and managers should consider the main objectives of the securities product and the rationale underlying the structure to evaluate how tokenization technology may complement the purpose and enhance utility. For example, a bond secured by real estate has a relatively short time to maturity as compared to a real estate private equity (PE) fund. Compared to traditional issuances, a tokenized bond product would benefit more from streamlined operations and automated post-issuance corporate action management such as coupon distribution, whereas PE funds could gain significant additional advantages from increased liquidity.

The issuer of tokenized securities must also seek professional advice to make informed decisions about which jurisdictions to include in the structure of the product. The regulatory framework governing tokenized securities will vary between jurisdictions while the different tax regimes across jurisdictions could have a significant impact on the price of the tokenized securities and its cost-effectiveness. Further, issuers should also seek advice regarding the location of target investors, as this will introduce regulatory considerations related to the marketing and offer of tokenized securities.

Fractional ownership allows the interests in an asset to be shared among a wide pool of investors, and the programmable nature of security tokens technically enables unlimited share classes and widely customizable fee structures at a low operational cost. With these new options available, issuers will benefit from clearly identifying the target investor base, including levels of investment capital commitment and anticipated demand for liquidity.

Governance

Unlike the first wave of digital asset financing mostly through unregulated Initial Coin Offerings (ICOs), security tokens and their offering have relatively clear regulatory implications and application to the business community. The regulatory regime entails requirements related to licensing, risk monitoring and reporting for the issuers of tokens, their service providers (such as operators of token exchanges), as well as the token investors.

Under existing regulatory frameworks, the creation, ownership and transfer of security tokens is generally regulated in a similar fashion as that of traditional securities. Accordingly, similar governance and regulatory considerations should be taken into account, including legal ownership, investor Know Your Customer (KYC) procedures & compliance, accounting, and investment due diligence, examples of which are set out below.

Legal Ownership

Setting up funds or trust structures as necessary to hold the underlying assets, and ensuring that token owners are granted rights and/or ownership through appropriate legal documentation.

Investor KYC & Compliance Ensuring that issuers, investors and technology providers understand and comply with local regulatory and licensing requirements, including, among others, the monitoring of token owners and service providers in accordance with local AML/KYC requirements.

Accounting Clarifying the nature of the underlying asset in order to account for the security tokens as “financial assets” under accounting principles, failing which the tokens may be qualified as “Inventory”.

Investment Due Diligence Understanding the market participants behind a tokenized security, including the background of the technology providers; understanding the assets backing the tokenized security and the rights attached to security tokens; and the issuance and transaction flow of the security through the issuance, distribution, and/or exchange platforms.

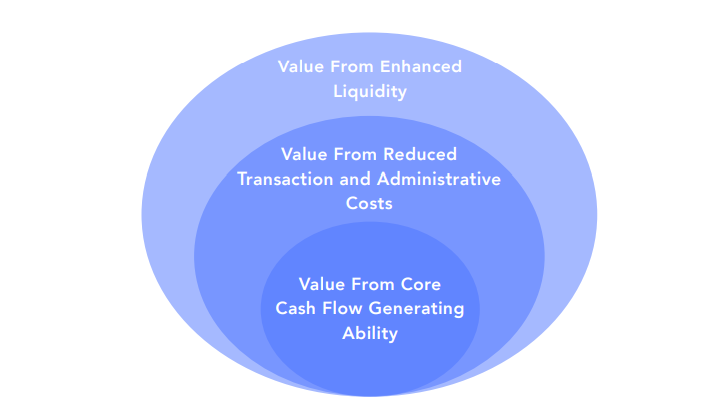

Valuation: Real Estate and Business

Valuation has many components. In addition to the future cash flow generating abilities of the underlying asset or business such as the abilities to generate rental income or sales revenue, other factors including transaction costs and market liquidity should also be considered.

For a tokenized asset, the core cash flow generating ability of the underlying asset or business does not change. However, the tokenization process can create value by enhancing the liquidity of an otherwise illiquid asset while also substantially reducing transaction and administrative costs, particularly for fractional ownership and secondary trading.

Value From Savings of Administrative Costs

The tokenization process can significantly reduce the administrative costs of owning an asset. Using built-in smart contracts, periodic administrative actions such as quarterly reporting or income distribution can also be automated, further reducing administrative and compliance costs. Assets with long-life and frequent administrative activities, such as real estate assets or PE funds, are particularly well placed to benefit from the cost savings offered by tokenization.

Value From Liquidity Premium

Liquidity is the ability of an asset to be readily converted into cash without suffering significant discount. The stock of a publicly traded company such as Alibaba or Apple is the perfect example of a liquid financial asset. An investor can buy and sell the stock of the company fairly easily without much delay or incurring high commission costs. When an asset is not liquid, an investor might not be able to buy or sell the asset right away, and therefore face uncertainty in price fluctuation between the time an investor decides to buy and the time the transaction closes. Transaction cost might also be substantial due to the illiquidity of the asset.

Large commercial properties are good examples of illiquid assets as each property is unique (lack of standardization) and requires large upfront investment. The transaction period for such investments are long, and once invested the owner tends to hold the asset for a prolonged period due to high transaction costs. A typical timeline from finding a property to closing the transaction can be anywhere from 6 months to 2 years, and the transaction fees range from 1% to 3% of the asset value.

In contrast, tokenization is ideal for owners of a single asset or a small portfolio of assets, due to the significant reduction of time and cost in offering investors the right to participate in fractional ownership and subsequent secondary trading.

The section on primary distribution will look at how liquidity and thus the valuation of a single real estate asset could be affected by tokenization, and the section on secondary trading will look at valuation considerations in private equity fund tokenization.

Taxation

Investing in digital assets which ultimately derive their value from real estate does not automatically mean that ordinary tax rules governing the direct holding of real estate apply, unless the digital asset in question legally represents a direct, fractional ownership in the real estate itself.

Where the digital asset held is instead a security, such as a share or bond in a company or a partnership interest, then the rules governing the taxation of gains or losses on the sale of shares, bonds and partnership interest, and distributions comprising dividends, interest and partnership distributions should similarly apply.

If the applicable regulatory framework permits ownership in digital form, it would generally be expected that local tax rules will apply in the same way as for direct ownership in traditional scrip form (although if this is not possible then a trust or custodian type arrangement may need to be implemented).

Accordingly, the fact that shares or partnership interests are held in digital form and transactions take place through smart contracts generally is not expected to alter the taxing provisions which govern the holdings in those interests. For some jurisdictions the tax rules may be very straight forward, but for other jurisdictions, where facts and circumstances determine the tax treatment, different results may conceivably arise.

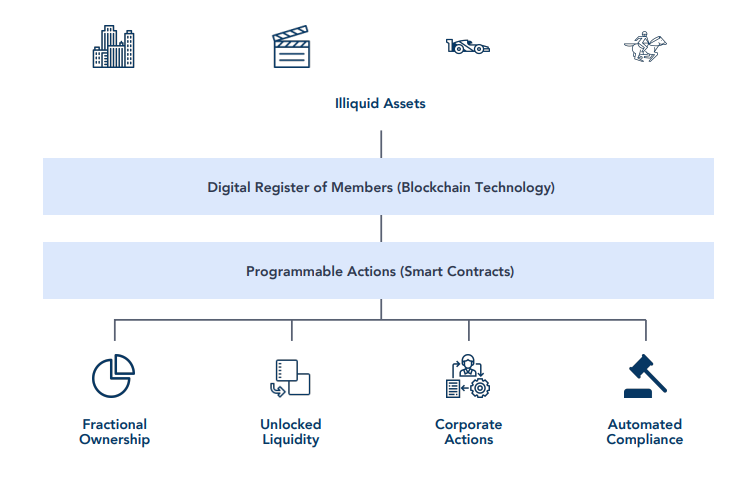

Phase 2: digitalization

Tokenization unlocks liquidity by enabling fractional ownership and lowering the barriers to entry for investment in illiquid assets.

Two core components of tokenization are blockchain technology and smart contracts. Blockchain technology helps to streamline processes by allowing separate stakeholders to have secure access to the same copy of data, which cannot be altered without validation from other stakeholders. The data central to tokenization is a digital ROM for the asset to be tokenized, which is uploaded to a blockchain as a complete record of ownership.

Although fractional ownership itself is not a novel concept, maintaining the ROM on a blockchain makes the management of fractional ownership drastically more efficient because the digital ROM can be updated almost instantly, and it is resistant to unauthorized alterations by unverified actors. Each transaction is encrypted and recorded on the blockchain, making sensitive data traceable but protectable by smart contracts.

Smart contracts form the building blocks of programmable actions, which is the key to unlocking liquidity. Smart contracts are coded to execute compliance protocols, due diligence, KYC, and antimoney laundering (AML) procedures, as defined by regulatory requirements and further specified by the terms set by individual issuers. Smart contracts also play a role in facilitating near-instant settlement of transactions.

Immutable transaction records on blockchain and a high degree of automation enabled by smart contracts bring much-needed process optimization and efficiency to investment. Other actions that are programmable throughout the investment lifecycle include investor and corporate action management, such as distributing dividends and holding shareholder votes.

Technology enables fractional ownership to be securely managed as a digital record, investor due diligence and compliance protocols to be automated, and transaction settlement to be completed digitally. The cumulative effect of these changes is to significantly reduce the time and economic costs associated with trading previously illiquid assets, which benefits asset owners and investors alike through unlocked liquidity. As regulatory regimes across the globe evolve to meet these technological developments, secondary market trading for tokenized assets will thrive.

Phase 3: primary distribution

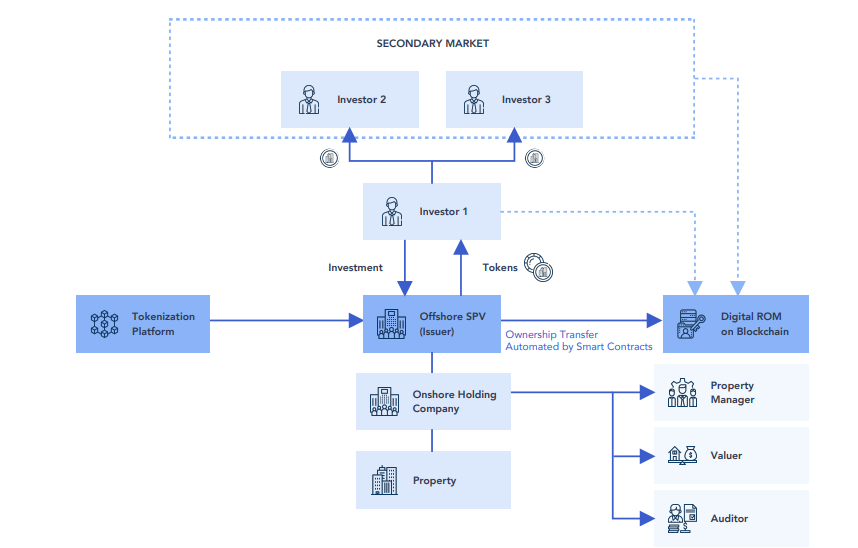

Example: Shares in a Company which Directly Holds a Property

The cost of investing in an individual real estate asset is very high, often carrying a significant upfront capital requirement which may be prohibitive to the average investor. Until recently, the concept of fractional ownership had been employed to address this barrier of entry principally in the form of real estate investment trusts (REITs), which enable investors to acquire a fractional ownership interest in a portfolio of real estate properties.

Tokenization improves on this model in several respects: it facilitates the implementation and management of fractional ownership and it simplifies the matter of ownership transfer and settlement.

Tokenization enables customizable fee structures inclusive of access premiums for previously-inaccessible investment opportunities, and reduced liquidity premiums for previously-illiquid assets.

Compared to traditional investment in a single property asset, a building tokenized for distribution as private equity could be distributed among a larger pool of investors at a lower per unit cost.

To tokenize an individual property, ownership of the property is held by a special purpose vehicle (SPV). Tokenization software is employed to create a digital ROM recording the complete ownership of the SPV (and therefore the property) on blockchain. Smart contracts are coded to reflect the terms of ownership, and tokens are issued to investors representing fractional ownership in the SPV (and therefore the property). Each investor’s fractional ownership is recorded on the digital ROM, and smart contracts are coded to automate certain corporate management actions including dividend distribution and shareholder voting.

Valuation of a Tokenized Single Real Estate Asset

A tokenized asset has the same cash flow generating ability of a traditional asset. In addition, tokenization adds value by increasing the asset’s liquidity and reducing transaction costs and administrative costs related to the investment. All these benefits should be taken into consideration when an investor is valuing an asset.

Tokenization is ideal for owners of a single asset or a small portfolio of assets because of the significant reduction of time and cost in offering investors the right to participate in fractional ownership and subsequent secondary trading.

The initial setup of a completely new tokenization workflow can be expected to take approximately 2 to 3 months, depending on the complexity of the project. Additional time will also be needed for the initial verification and on-boarding of investors.

However, after the initial token issuance, fractionalized ownership interests can be easily and efficiently traded within their designated network or marketplace, as most of the investment procedures including KYC and AML will be automated in the tokenization process.

The time saving resulting from tokenization, compared to traditional finance transactions, can be anywhere from 6 months to 1 year for transactions involving fractional ownership interests in real estate. The cost for secondary trading will likely be a fraction of the cost for traditional property transactions.

Taxation of Tokenized Shares in a Company which Directly Holds a Property

Take a hypothetical case involving a Hong Kong-based corporate investor subscribing for new shares in a Cayman Islands incorporated and tax resident company, ownership of which is represented in the form of a digital token. The Cayman company in turn contributes the cash received to subscribe for new shares in an Australian company, which then purchases Australian real property and holds no other assets.

As the asset in this case will comprise tokenized shares in the Cayman company, ordinary Cayman and Australian tax rules should be expected to apply. The Cayman and Australian rules relating to tax on a sale of the tokenized shares should be straight forward. There will not be any Cayman Islands tax, but there will be an Australian tax of 30% on the gain by the Hong Kong investor, since Australia taxes gains on the sale of shares situated anywhere in the world where at least 50% of the value of the shares being sold is attributable to Australian real property.

From a Hong Kong profits tax perspective, the tax treatment requires further consideration. Taking trading gains for example, profits tax is charged on Hong Kong sourced gains from a trade or business carried on in Hong Kong. This will be further discussed in the section on trading below.

Phase 4: post-tokenization management

In post-tokenization management, smart contracts enforce automated corporate action management processes, including dividend distribution and shareholding voting. Smart contracts also facilitate the swift settlement of token transfers. Issuers retain control over the final approval or rejection of investors who pass automated restrictions before token transfers are finalized. Every transaction throughout the life of a security token is recorded immutably on blockchain.

Example: Bonds Secured by Real Estate

Bonds secured by real estate are fixed-income investments or loans, and generally offer a relatively stable yield.

Tokenization can significantly reduce the cost of bond issuance by streamlining and lowering the multitude of costs that are incurred throughout the lifecycle of a bond, by using blockchain technology for the digital issuance, trading and management of the bond.

After company information is recorded on blockchain, smart contracts are coded with the terms of the bond issuance. Investors are issued with tokens which are a digital representation of the bond.

Settlement, trading, and post-issuance coupon payments can be executed by smart contracts.

Phase 5: secondary trading

One of the most important benefits of tokenization is its ability to bring liquidity through secondary market trading. Real estate is an attractive asset globally, and particularly so in Asia and Hong Kong. Proven market appetite for traded REIT products demonstrates the demand for secondary market trading of real estate investment products. Illiquidity of real estate is likely not due to lack of demand, but more a result of high capital requirements, long lock-up periods, and arduous transaction processes.

A disadvantage of REIT investments is the lack of control over the rebalancing of exposure to individual assets within the REIT portfolio. Tokenization first addresses the problem of accessibility through fractional ownership, then enables the swift settlement and transfer of these fractional interests in single real estate assets, facilitating flexibility and customizability in portfolio construction that is unavailable to REIT products.

Tokenization also facilitates liquidity for a wider variety of real estate assets. For example, capital invested in project financing is currently locked up for a long period, and delays in development could lead to heavy losses. A tokenized fund for project financing would have the appeal of enabling secondary trading, allowing investors to exit their investment before the term of the fund expires.

Regulatory Landscape: Operating a Platform for Secondary Trading of Security Tokens - Hong Kong

Access to the trading platform must be limited to Professional Investors only. Operator must comply with the “Licensing Terms and Conditions for Virtual Asset Trading Platform Operators” issued by the SFC in November 2019. Requires a license to conduct Type 1 (dealing in securities) and Type 7 (automated trading services) regulated activities from the SFC.

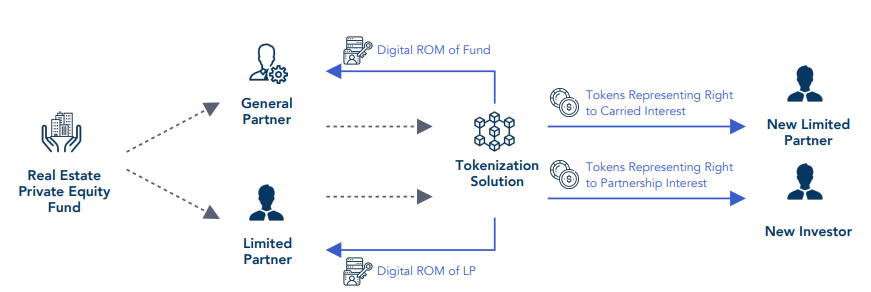

Example: Real Estate Private Equity Fund

Real estate funds have attracted much attention in the field of tokenization, as the intermediate structure of a fund is particularly suitable for the technical implementation of tokenization, which requires the initial step of creating a digital ROM on blockchain. Interests in a fund can be tokenized whether or not the underlying assets of the fund are tokenized, although tokenized real estate assets could offer further customizability and flexibility from the direct link to underlying value drivers. At the fund level, the tokenization of interests in the fund itself can yield the benefits of fractionalization, operational efficiency, and liquidity, especially for private equity funds with long lock-up periods and high minimum investment amounts which act as a significant barrier to entry.

In private equity (PE) funds with a partnership structure, the partnership interests of both the general partner (GP) and limited partners (LPs) can benefit from tokenization. The GP would retain part of its ownership for management purposes, and tokenize part of its economic interests in the fund, resulting in the GP having more capital available for further acquisitions or other business purposes.

The tokenization of LP interests in a fund would enable liquidity allowing existing LPs in the fund to transfer all or part of their interests in the fund to new investors who would be entered into the fund’s digital ROM upon transfer of the LP tokens. This means that investors wishing to rebalance their portfolio would be able to transfer the interest that they hold in the fund to another investor and cash out ahead of expiry of the fund term. This would bring much-needed flexibility and liquidity to investments in real estate funds and enable a broader base of investors to participate in a market with greater liquidity. For fund managers, the costs and burden associated with facilitating transfers of fund interests between LPs would be significantly reduced for tokenized fund interests as compared to over-the-counter trading.

Valuation of Tokenized Private Equity Funds

The benefits of time and cost savings are also directly applicable to PE funds, another (traditionally) highly illiquid asset class.

Traditionally, once an investor has made a commitment to a PE fund, they can be committed for up to 10 years or more. If an investor needs to exit the investment prior to the end of the PE fund’s term, the investor will need to undertake an arduous and challenging process including finding a potential buyer, enabling the potential buyer to complete due diligence, and then agreeing the form of legal documentation for the sale of its interest in the PE fund. This process can take between 6 months to 1 year, and the selling investor will likely need to dispose of its interest at a discount on net asset value (NAV).

Recognizing the benefits of tokenization for investors in illiquid funds, certain PE funds in the US and Europe have already started tokenizing interests in their funds, which will enable limited partners (LPs) to trade ownership of fund interests much more efficiently.

One of the methods that valuation professionals use to assess the liquidity premium or discount is the option pricing model, which is to assess the cost of buying an option that can hedge the price fluctuation during a predetermined period. The time to maturity and volatility of the asset are the key factors to determine the option price.

For example, the option to hedge the price of a stock in 6 months with expected 10% volatility in this period is around 3% of the current stock price, and if time to maturity increases to 1 year, the price of the option will increase to around 4.5% of the current stock price. To assess the value of the time-saving factor of the tokenization process, a valuer can consider how much it would cost to enter a private contract with a broker to hedge the price for the duration of the transaction time. Compared to buying a standard stock option, a private hedge contract is almost always much more expensive, if available at all.

When a private company goes public, the liquidity premium can be anywhere from 10% to 50%. However, at current time, most of the tokenized assets such as large commercial properties or PE funds are only available to qualified investors, which are high-net-worth individuals or institutions. Therefore, the added liquidity premium from tokenization is still not comparable to an IPO of a company. Nevertheless, with the increasing acceptance of blockchain technology and related applications such as tokenization, as well as the advancement of regulatory frameworks of governments around the world on tokenized assets, the liquidity premium of such assets will continue to increase.

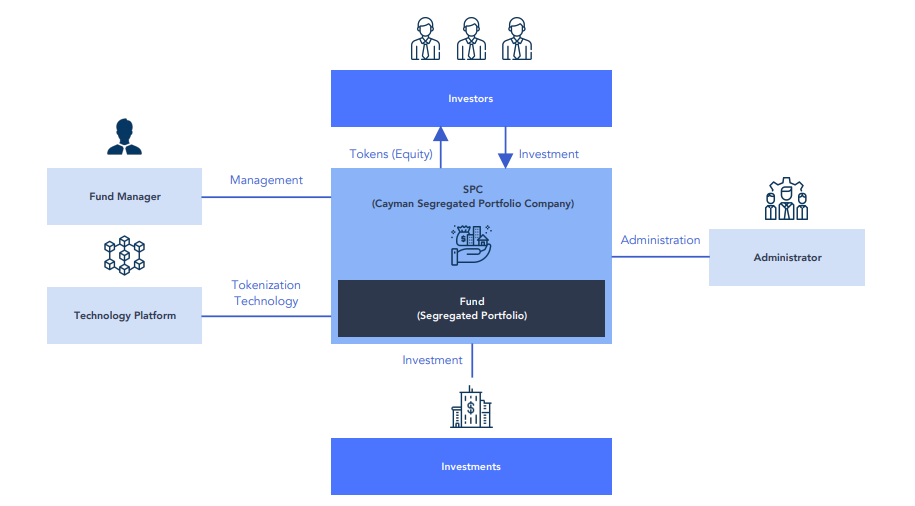

Case Study: Asia’s First Tokenized Fund

In 2019, Sidley advised a Hong Kong based fund manager (Manager) on the structuring and establishment of the first tokenized fund in Asia (Fund).

The Fund invests in illiquid assets which, similar to most funds investing in real estate assets, requires (i) a lengthy Fund term to ensure that the Manager has sufficient time for the acquisition, appreciation in value and disposal of investments, and (ii) a closed-end structure, meaning investors do not have the right to redeem or withdraw their interest from the Fund.

As this Fund is the first in a series of funds that the Manager will establish for the purpose of investing in the same class of illiquid assets, the Fund has been established as the first segregated portfolio under a segregated portfolio company (SPC) domiciled in the Cayman Islands, which provides certain time and cost efficiencies.

To attract a broader base of investors, the Manager engaged a technology platform to tokenize 100% of the equity interests in the Fund, which will enable secondary market liquidity.

Investors in the Fund are issued digital tokens (which represent equity interests in the Fund) in a ERC20- compatible digital wallet. While investors cannot redeem from the Fund during the term of the Fund, investors can sell all or part of their tokens to other investors on the secondary market, subject to compliance with transfer restrictions which are embedded in the smart contract in the technology platform.

The Fund’s register of members records the ownership of equity interests in the Fund. The register of members is maintained in a book-entry ledger by the Administrator and also a blockchain-based ledger on the Technology Platform.

The groundbreaking establishment of the Fund has paved the way for other asset managers in Asia to tokenize funds. Fund managers are expected to embrace tokenization, particularly in the closed-end segment of the market, because of the clear advantages that will make investments in closed-end funds more attractive to wider range of investors.

Challenges and opportunities

While tokenization promises to address many obstacles and democratize access to real estate investment, given the nascent stage of tokenization, there are some issues that must be considered.

Legal and Regulatory Uncertainty

Unlike traditional asset classes, the novel nature of security tokens means that the law and regulations in this area are not settled nor have they been tested by courts and regulatory authorities. Although some guidance has been issued by various regulatory authorities around the world in relation to security tokens, it is likely that new developments and changes in the laws and regulations will be introduced as the technology is increasingly embraced and the market continues to develop. Further, there can be no guarantee that that the regulators and jurisdictions which are currently supportive of, or do not oppose, the utilization of tokenization will continue to do so in the future.

Accordingly, the legal and regulatory requirements and restrictions for the offer, distribution, holding, trading and management of security tokens may change in the future. This may result in uncertainty for both issuers of and investors in security tokens alike, which may impair adoption and secondary market liquidity.

However, it should be noted that certain jurisdictions make a distinction between security tokens and cryptocurrencies. A fundamental difference between a cryptocurrency and a security token is the way that value is derived. The value-drivers of a real estate security token come from the underlying real asset itself, making the value of a real estate security token less volatile, and more easily determinable, than the value of cryptocurrency. Further, security tokens typically fall within the scope of existing securities regulations, even in jurisdictions where cryptocurrencies are unregulated or banned, such that investors in security tokens may be afforded better protections and rights than investors in cryptocurrencies.

Confidentiality

Generally, real estate funds and transactions are confidential in nature. Managers of and participants in such projects generally do not want to disclose the commercial terms or other sensitive commercial information, other than to a limited number of interested prospective investors who will be subject to nondisclosure obligations. Sometimes such confidentiality may even be a regulatory requirement if, for example, the underlying project relates to a listed or regulated entity.

Historically, maintaining such confidentiality has not been a problem for real estate transactions and funds, as they are generally only offered to a small number of institutional, corporate and high net worth investors who will generally be subject to a long lock-up often until the end of the term of the project. However, in the context of security tokens which may be listed on an exchange for secondary trading, the disclosure of commercially sensitive information to a wider range of potential investors will be necessary to facilitate investments and transactions.

The balance between data transparency enabled by blockchain technology and information privacy required in financial transactions will be an important area of development. Data Privacy on public blockchains can be protected by protocols such as Zero-Knowledge Proof, where one party can verify their knowledge of certain data to a counterparty without revealing what the data is. With further development and diligent structuring, blockchain protocols will enable data transparency that protects stakeholders against unlawful or inappropriate concealment of information without revealing confidential business data.

Current Illiquidity

One of the biggest promises of tokenization is to bring liquidity to previously illiquid assets, in particular by facilitating secondary market trading on exchanges globally. Liquidity will be one of the key drivers of the security token market. However, liquidity of security tokens on existing international exchanges is currently relatively low, meaning that the full potential of tokenization has yet to be realized.

A lack of secondary market demand for fractionalized real estate investment products could conceivably result in secondary market liquidity failing to develop in the future, however the performance of publicly traded REITs suggests that this is unlikely to be the case: for example, publicly traded US REITs have an average daily dollar trading volume of US $9.7 billion.

Other factors underpinning the current low levels of liquidity are undoubtedly the lack of regulatory clarity, which has resulted in a lack of understanding in the market, and the absence of regulatory frameworks to facilitate the development of infrastructure needed to facilitate secondary market trading of security tokens. In this respect, regulators globally have recently advanced quite considerably. The International Organization of Securities Commissions published a consultation report in May 2019 with key considerations and toolkits for jurisdictions to regulate virtual asset trading platforms while the SFC issued a position paper on 6 November 2019 setting out a new regulatory framework for virtual asset trading platforms. These and other recent developments mean the operation of regulated exchanges for secondary market trading of security tokens can be expected in the future, which is widely expected to boost secondary market liquidity of tokenized securities.

The future of real estate tokenization

Real estate tokenization projects so far have been closely based on traditional business models, which is a prudent precaution to take in adopting new technologies. As the technology and business models around tokenization continue to mature, the technology can be used not only to improve existing business operations, but to create new business opportunities. Tokenization brings the potential to integrate avenues of value creation and align various stakeholder interests. In the future, tokenization can be applied to employee incentive programmes, lease-to-own arrangements, and co-working spaces.

Conclusion

Traditional real estate investment involves significant financial commitments, lengthy processes, excessive paperwork, and siloed information. Tokenization addresses these problems by bringing operational efficiencies and information transparency to real estate transactions and bringing the additional benefits of fractionalized ownership and liquidity to real estate investment.

The adoption of technology promises to benefit, and be accretive for, all stakeholders in the real estate ecosystem.

From an issuer’s perspective, fractionalization allows them to reach a wider investor base with a larger pool of investment capital, while streamlined processes and automation reduce operational costs in the lifecycle of the tokenized security. Settlement facilitated by blockchain technology makes the transfers of ownership rights in the asset faster and more secure, with an immutable record of ownership always tracked on blockchain.

For investors who previously have been unable to afford the high upfront capital requirements of property investment, tokenized real estate enables accessible investment opportunities in this asset class for the first time. For larger investors seeking portfolio diversification, tokenization facilitates customized portfolio rebalancing with near-instant settlement, so investors can sell or buy tokens to adjust their exposure to a particular asset, and flexibly manage a wider range of assets in their portfolio, including traditional assets such as real estate and exotic assets such as sports teams.

Traditional intermediaries such as valuers, auditors and brokers will benefit from increased accuracy and availability of data, with sensitive information protected by encryption against unauthorized parties. The automation of processes eliminates repetitive work and minimizes manual error, freeing time and economic resources to focus on value-add aspects of deal structuring for tokenized real estate assets.

Although the adoption of tokenization in financial instruments remains relatively nascent, regulators and regulatory frameworks around the world are rapidly adapting to embrace and foster the continued development of this new wave of financial innovation. The next step that will be critical to the broader adoption and rapid advancement of tokenization in real estate investment is institutional involvement and the development of business frameworks. Technology is an indispensable facilitator, but technology alone cannot dictate the outcome. For the promised benefits of tokenization to be fully realized, stakeholders with the knowledge, experience and influence must work together to build an ecosystem that is greater than the sum of its parts.