Poland

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Poland

Investing in Polish property is a solid option, as the country's economy has performed exceptionally well in recent years, with a growth rate exceeding 3% annually for the past eight years. Additionally, unemployment levels remain very low, hovering at just 3.5%, and the national debt is relatively low when compared to other EU nations. With a GDP per capita of approximately USD 16,000 per year and a continuing upward trend, Poland remains one of Europe's fastest-growing economies. Furthermore, many corporations have relocated their back offices to Poland.

Poland takes pride in its highly educated population, with the majority of its people being literate and able to speak foreign languages. There are many flights in and out of Polish cities, including low-cost airlines that offer several flights to all Polish cities daily. Additionally, investing in real estate in scenic locations such as lakesides, mountains, or the coast can be very lucrative.

While property prices in major cities range from EUR 2,000-5,000, the market remains robust and is steadily increasing. Rental yield also offers a favorable return, averaging up to 12% annually.

Note that Lee & Bronski can suggest investment apartments that offer an even higher yield.

Transaction costs for buying property in Poland are relatively low. Real estate agents' commissions are approximately 2%, and notary fees range from 1.5-2%, with higher-end properties carrying lower fees. For new properties purchased from developers, a 23% VAT applies.

Residence permits based on real estate ownership

Residence cards are issued to individuals who are starting businesses. To qualify for the residence permit, entrepreneurs must demonstrate an ability to earn an annual income of at least EUR 15,000. The business can be related to property investment, management, and other industries. It is worth noting that numerous foreign companies have already entered this line of business, making it a popular choice for many aspiring entrepreneurs.

Residence permits based on new company formation

Residence cards are issued to people starting up businesses. The entrepreneur has to demonstrate that they can make an annual income of at least EUR 15,000 to be eligible for the residence permit. Business can be related to property investment, management etc. Thousands of foreign companies have already entered this line of business.

Taxes & Rental income tax

The tax implications for property ownership in this region are worth noting. Property income tax begins at a rate of 8.5%. Capital gains tax is set at 19%; however, if you retain ownership of the property for at least five years, you will be exempt from paying this tax. VAT is set at 23%, corporate tax at 20%, and income tax at 19% or 32%. Social security tax rates vary and can be as high as 35%, though there may be certain exemptions available. It is important to be aware of these taxes when considering investing in property in this region.

Other residence types in Poland

There are various types of residence permits available in Poland, including education and spouse visas, among others. Lee & Bronski can help find a solution tailored to your specific needs. Whether you are interested in residing in Poland for work, education, or personal reasons, Lee & Bronski is equipped to provide assistance and guidance throughout the process.

Which residence permits offer a path to permanent residency and citizenship?

To apply for a Polish passport, you must have maintained permanent residence in the country for a minimum of five years. Additionally, you will need to demonstrate that you either own or rent an apartment and have a source of income. It is also necessary to pass a language proficiency test in Polish.

Obtaining a Polish passport has significant advantages, as it allows for visa-free travel throughout the European Union, as well as to the United States and Canada.

Restrictions

Foreigners who stay in Poland for more than 183 days a year are subject to a worldwide income tax. However, becoming a fiscal resident may not always be the most advantageous option, particularly if you are from another EU state.

It is also worth noting that all entrepreneurs are required to pay for their own social insurance, as well as that of their employees. The insurance provides coverage for free health services for the policyholder, their spouse, and their children.

The country's strong position on the map of business-friendly places is reflected in actual business transactions and investments. In 2019, Poland was also ranked highest in the CEE region and third in Europe in terms of greenfield investment value - USD 21.8 billion. It is no coincidence that at the end of 2020 Poland is the third preferred location in Europe for foreign investments, and despite the pandemic, we have nearly 200 foreign investments in this year's portfolio with a total record value of EUR 10 billion!

GROWTH & BUSINESS ADVANTAGES

In 2020, Poland experienced a GDP contraction of only 3.5%, which is significantly less than the OECD average of 5.5%. Comparatively, the UK's GDP contracted at a staggering rate of 9.9%. Despite the pandemic's impact on economies across Europe, Poland's official unemployment figures have remained relatively stable and are currently the lowest in the European Union, according to the latest Eurostat data.

It is also important to note that Poland's economy was performing well before the pandemic. The IMF's World Economic Outlook from October 2019 forecasted a growth rate of 3.1% for 2020. While the Polish economy's growth rate fell short of the projected figure, with a 6.6 percentage point drop, it is still a milder slowdown than that of many other countries. For instance, the Czech Republic experienced an 8.1 percentage point drop (from +2.6% to -5.5%), Hungary had an 8.3 percentage point drop (from +3.3% to -5%), the UK's drop was 11.4 percentage points (from +1.4% to -10%), and Spain had a nearly 13 percentage point drop (from +1.8% to -11%).

According to research conducted by KPMG among nearly 1,300 CEOs worldwide, 83% of CEOs are positive about the prospects for their companies' development over the next 12 months. Of those, 65% perceive technological advancements as an opportunity for growth, rather than a threat to their business. In Poland, this percentage is even higher, with 96% of CEOs considering technological advancements as an opportunity for development.

REAL ESTATE TRENDS

Real estate prices have been rising for months. Secondary market prices are rising literally everywhere and for any type of property. However, the largest increases are in the area of plots and detached houses. Prices of apartments increased the most in Gdynia (8.3%), Gorzów (7.6%) and Sopot (6.1%). In Poznań, the prices of flats increased by 4.1% on average, while in Warsaw - by 3.8%. "Own house at any cost" is the right way to explain instant swipe of detached compounds off the market.

Read More ...

STATS & MORE

.

Czechia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in the Czech Republic

The Czech Republic offers a relatively easy process for acquiring residence permits, which can lead to citizenship in just 5 years. The country has experienced solid GDP growth, with a current GDP per capita of 22,843 EUR. Interest rates and inflation are low, while growth rates are high, and unemployment rates remain at very low levels.

While properties in Prague are considered to be heavily overvalued, they still represent an interesting investment direction, especially given that Czechia is a developed economy with a stable property market. However, yields are not particularly high, with a 3-4% yield being possible.

In addition to its stable economy, Czechia is known for its strong work ethic and numerous opportunities. Moreover, Prague is strategically located in Europe, with major cities such as Berlin, Vienna, and Wroclaw all within a 350 km radius. The country's population is also growing, with an expected increase in the coming years.

Property purchase costs in the Czech Republic are relatively low, with the 4% real estate transfer tax having been abolished. Real estate prices outside the city center range from 3,500 to 4,500 EUR, while prices in the city center or business district are considerably higher.

Residence permits on the grounds of owning real estate

There are no restrictions on foreign buyers in the real estate markets. You can set up a company dealing with real estate or any other line of business. Once you are there you can simply increase your assets by purchasing a real estate.

Residence permits on the grounds of company formation

If you're looking to move to a new country and establish a business, the Czech Republic offers a relatively quick and straightforward process. To start, you'll need to prove that you have around 15,000 EUR in your bank account and can support yourself financially. Additionally, you'll need to participate in the national healthcare scheme and provide proof of a place to stay.

Once you've met these requirements, you can apply for a residence permit for yourself and any dependents. The application process typically takes between 3-6 months and is generally straightforward.

Overall, setting up a business in the Czech Republic is a great way to establish yourself in the country and enjoy all it has to offer. With a relatively low cost of living, a stable economy, and a supportive business environment, it's no wonder that many people are choosing to call the Czech Republic home.

Taxes & Rental income tax

One of the benefits of investing in property in the Czech Republic is the relatively low Rental Income Tax. This tax ranges from 15% to 23%, and there is also a standard deduction of 30% for expenses, including Capital Gains Tax (CGT).

When it comes to CGT, it is added to your gross income in the year of the sale. However, if you keep the property for at least 10 years after purchase, you are exempt from paying CGT.

It's worth noting that the general income tax in the Czech Republic is 15%, which is relatively low compared to other European countries. Additionally, there is no wealth tax, which can be an added benefit for property investors. Overall, the tax system in the Czech Republic is relatively straightforward and can be quite favorable for those looking to invest in property.

Other residence types in Czechia

While there are many types of residence permits available in the Czech Republic, as an investor, you may be primarily interested in the company formation model. This model is often the most straightforward and quickest way to obtain a residence permit.

By setting up a company in the Czech Republic, you can not only obtain a residence permit for yourself and any dependents but also take advantage of the country's favorable tax and business environment. Additionally, the process for setting up a company in the Czech Republic is relatively simple, with many resources available to help guide you through the process.

Overall, if you're looking to establish a long-term presence in the Czech Republic and take advantage of all the benefits it has to offer, setting up a company may be the best route to take. With a supportive business environment and a range of resources available to help you navigate the process, it's no wonder that more and more investors are turning to the Czech Republic as a destination of choice.

Which residence permits offer a path to permanent residency and citizenship?

There is a variety of residence permit types leading to acquiring the passport. It guarantees access to the Schengen Zone, US and Canada.

Restrictions & Challenges

While the Czech Republic offers many advantages for property investors, there are also some potential drawbacks to consider. One of these is the relatively high property prices, particularly in certain areas like Prague.

Additionally, the property market in the Czech Republic is relatively mature, and it's unlikely that tourism will continue to grow at the same rate as in recent years. This means that investors should be prepared for potentially slower growth in the future.

Another potential issue is the shortage of available development sites. While there are still opportunities for investment, particularly in more outlying areas, investors should be prepared to do their due diligence and be patient when looking for the right opportunities.

Despite these challenges, the Czech Republic remains an attractive destination for property investors, thanks to its stable economy, favorable tax environment, and strategic location within Europe. By doing your research and working with trusted local partners, you can take advantage of all the opportunities that the Czech Republic has to offer.

The Czech Republic is widely regarded as one of the most developed countries in Central and Eastern Europe, and its success can be seen in the high levels of foreign investment it attracts. Many businesses operating in the country are incorporated with foreign capital, and investment is flourishing in sectors such as real estate, strategic services, manufacturing, tourism, and more.

There are several factors that make the Czech Republic an attractive destination for foreign investment. For one, the country boasts a highly skilled workforce and a favorable business environment, with a stable political system and a well-developed infrastructure. Additionally, the government offers various incentives to foreign investors, including tax breaks and subsidies.

The real estate sector is particularly popular among foreign investors, thanks to the high demand for housing and commercial space in cities like Prague. The country's strategic location within Europe also makes it an attractive destination for businesses looking to expand their operations and tap into new markets.

Overall, the Czech Republic offers a range of advantages for foreign investors, and its continued economic growth and stability make it an appealing destination for those looking to invest in Central and Eastern Europe.

GROWTH & BUSINESS ADVANTAGES

The Czech Republic, like many other economies around the world, suffered a significant setback due to the COVID-19 pandemic. The country's sustained growth up to 2020 was disrupted, leading to a decline in domestic demand, tax revenues, and exports. As a result, the Czech economy contracted by a projected 5.6% in 2020, although this was a slower decline than the EU average.

However, the country is expected to experience positive GDP growth in 2021 and 2022, although it is not expected to return to pre-COVID levels until 2023. One of the most affected sectors of the economy was the automotive industry, which is the largest sector of exports in the country. The industry accounts for a significant portion of the GDP and labor force, with Skoda being the leading producer.

Services contribute significantly to the Czech GDP and employ a considerable portion of the active population. The tourism sector, in particular, is a significant contributor to employment and economic growth, with Prague being a premier tourist destination in Europe.

Foreign investors in the Czech Republic can benefit from investment incentives, which are available for manufacturing, technology centers, and business support services centers. Additionally, there are opportunities for investment in various sectors, including aerospace, automotive, cleantech and energy, electronics, software and ICT, and life sciences.

Overall, the Czech Republic remains an attractive destination for foreign investment, with its strategic location in Central Europe and a skilled labor force. Despite the setback caused by the pandemic, the country is expected to rebound and continue its trend of sustained economic growth.

REAL ESTATE TRENDS

The Czech Republic has long been known for having the most expensive residential property market in Central Europe. According to data from Deloitte, the average price of a new apartment on the local market was EUR 2,525 per square meter in 2018, and in Prague, prices on the primary market have soared to as high as EUR 3,200 per square meter. This is in stark contrast to neighboring Poland and Hungary, where average prices are around EUR 1,370 and EUR 1,323 per square meter, respectively.

Over the past few years, transaction prices for flats in the Czech Republic have continued to rise, increasing by an average of 9.8% in 2018 and 8.9% in 2019. As a result, some Czech residents have started to look beyond their borders for more affordable housing options. For example, residents in the northwest of the country have shown interest in the German housing market, where the average price of a second-hand apartment in cities like Chemnitz (with approximately 250,000 inhabitants) hovers around EUR 1,000 per square meter.

Despite the high prices, the Czech property market remains attractive to many investors, thanks to the country's stable economy, favorable tax environment, and strategic location within Europe. However, investors should be prepared to do their due diligence and carefully consider their options when looking to invest in this market.

STATS & MORE

via Company formation

Greece

PROPERTIES & RESIDENCE

Advantages of purchasing estate in Greece

Greece offers a 5-year residence permit to non-EU citizens who invest a minimum of 250,000 EUR in real estate. However, the total cost of the transaction, including taxes and fees, is approximately 300,000 EUR, with government costs and legal documentation amounting to 6% and lawyer fees ranging from 3-4%. The process of obtaining the residence permit for yourself and your dependents (up to 21 years of age) takes only 6 weeks, and you do not need to live in Greece to renew your permit.

You can exchange the property you invest in for another real estate within the 5-year period. There is no limitation on the number of properties you can purchase, but you need to reside in Greece if you want to become a permanent resident. It is worth noting that Greece has a poor track record of naturalizing people.

Restrictions & Challenges

Property taxes are relatively high.

Medical insurance of 300 EUR must be paid during the time of the residence permit.

Ms. Shuping Li, General Manager of Bank of China (Luxembourg) S.A. Athens Branch, highlights the bank’s role as a bridge that facilitates mutually beneficial cross-border business and investments between Greece and China. She reflects on key investment opportunities in Greece in sectors like energy, infrastructure, tourism, and agriculture.

GROWTH & BUSINESS ADVANTAGES

Greece's economy is projected to grow by 4.5% next year after a strong rebound this year on stronger tourism, pent-up demand and a boost from state support measures, the government's draft 2022 budget projected on Monday.

The government recently revised upwards this year's projected economic growth rate to 6.1% from 5.9%.

"The economy has already recovered more than two-thirds of the lost gross domestic product in one year, even though economic activity still faced restrictive measures in the first half," Finance Minister Christos Staikouras said.

On Friday Fitch Ratings said Greece's stronger-than-expected economic performance in the first half led it to upwardly revise its full-year 2021 GDP growth forecast to 6.0%.

Greece's economy roared back in the second quarter after a pandemic-induced 8.2% slump last year, growing at a better-than-expected annual rate of 16.2% as consumer spending and investments picked up.

"It seems that regaining the pre-pandemic GDP will take place sooner than expected, in the first half of 2022," said National Bank's chief economist Nikos Magginas.

EY’s survey for Greece, based on a sample of 253 companies worldwide, confirms the improvement of the country's perceived attractiveness. It is worth noting that the improvement comes, for the first time, to a large extent, from companies that have not yet invested in the country and, to a lesser extent, from those already established in Greece.

62% of the sample’s executives, compared to 38% last year, stated that their perception of Greece as a location where their business might establish or develop activities, has improved over the past year, while not a single company surveyed reports that its perception has deteriorated significantly. At the same time, optimism for the coming years is intensifying, with three out of four respondents (75%), compared to 69% last year, expecting the country's attractiveness to further improve over the next three years.

The share of those who believe that Greece is currently implementing an attractiveness policy that attracts global investors has increased, for the second consecutive year, to 71%, from 62% in 2020 and 50% in 2019, indicating that investors attribute the improvement of the country’s attractiveness to the pursuit of specific policies and not simply to the end of a protracted period of economic and political uncertainty, as was likely the case in 2019.

On the fiscal front, next year's draft budget projects the primary budget balance, which excludes debt servicing outlays, will see a deficit of 0.9% of economic output, down from an expected 7.7% of GDP gap this year.

Greece's public debt is projected to drop to 190.4% of GDP in 2022 from an expected 197.9% this year.

Unemployment is seen falling to 14.3% next year from 16.0% this year, the draft budget projected.

REAL ESTATE TRENDS

"Buying real estate in Greece makes sense only for your own residential purposes" - summed up the experts, stating that in modern conditions investing in Greek real estate is not a good idea. "The most important obstacles to the recovery of the Greek real estate market are the steady increase in the tax burden on real estate, high transaction costs, and continued tax instability," said Ekaterina Tein, Greek real estate specialist. The expert is confident that real estate prices in Greece will continue to fall by at least 3-5% annually. According to her, housing in holiday regions has become so affordable that it is in great demand among the Russian client. “It would seem that the real estate market is worse than ever for the Greeks and the Greek economy. The regrettable results of recent years clearly show that, from an investment perspective, the real estate market in Greece is absolutely unattractive and will remain so for at least another 2-3 years, ”said Igor Indriksons, another real estate specialist in Greece.

STATS & MORE

Estate purchase worth €250,000

Hungary

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Hungary

Hungary boasts a strategic location in the heart of Europe and enjoys a mild south-central climate that provides great weather from March to mid-October. With Wizzair, the Hungarian airline, offering connections to hundreds of destinations across Europe every day, including over 30 flights to London daily, it's a great hub for travel.

Real estate prices are moderate, ranging from 1.5-3k EUR/m2, and offer a growth yield of around a reasonable 6%. Tourism has steadily increased over the last 25 years from 3 to 9 million visitors per year, making it a popular destination for travelers.

Hungary's economy is stable, with a growth rate of around 5% annually and a decreasing national debt. The unemployment rate is very low at 4.5%, making it an attractive place for job-seekers.

Budapest, the capital city, is a great expat center, with a diverse community of EU citizens, Russians, Chinese, and other nationalities. The Hungarian passport offers visa-free travel to all Schengen countries, the US, New Zealand, the UK, Australia, and Canada, making it a convenient base for international travel.

Hungary's healthcare and education systems are quite good, providing access to quality medical care and education for residents and expats alike.

Residence permits on the grounds of owning real estate

To invest in property, a minimum investment of 250,000 EUR is required for personal ownership. While incorporating a company may be a cost-effective option, it is not recommended for those who only intend to own a single property.

Residence permits on the grounds of company formation

If you plan on generating revenue from leased properties, setting up a company to own the property can be a viable option. With a minimum investment threshold of 180,000 EUR, the company can also be involved in other areas of business besides property management. When it comes to rental income tax, you have a choice between two options: 10% of the gross income or 15% of the net income. Additionally, you can deduct any relevant costs when submitting your taxes to the tax office.

Other residence types in Hungary

Foreign entrepreneurs can participate in the foreign investment program through business formation with a minimum investment of 50,000 EUR. However, it's important to note that becoming an EU national is not possible before applying for this type of visa. As part of this program, business owners become the controllers and pay taxes as hired employees. It's worth noting that the government bonds residency program, which offered residency based on investment, was suspended in 2017 and is no longer an option.

Which residence permits offer a path to permanent residency and citizenship?

All the previously mentioned programs open the path to permanent citizenship after 8 years of temporary residency.

Restrictions & Challenges

The cost associated with buying and selling a property in this country is approximately 10% of the property's value. Taxes involved in the purchase include a stamp duty of 4%, a VAT of 20%, and legal costs of 1%. Non-EU citizens will also need to pay an additional 200 EUR as a permission fee. Capital Gains Tax (CGT) is set at 15%, although the rate can be decreased based on how long the property is held. The longer the property is held, the lower the CGT, and there is no CGT after 5 years of owning the property.

After holding temporary residence for 8 years, applicants and their dependents (such as spouse and children under 18 years old) can apply for citizenship. However, passing a language test is required for the citizenship application.

Three words are to describe why you can consider Hungary as an ideal location for your growing business. Hungary is a bustling business hub situated right at the very heart of Europe; physically and in historical, geographical, cultural and economic terms, all destinations are within easy reach. As a full European Union member, companies coming to do business here join the EU market of more than 500 million people. Now, it’s your turn to explore the opportunities that Hungary can offer your business.

GROWTH & BUSINESS ADVANTAGES

Hungary is a modest performer among emerging economies and its high dependence on exports, in particular on automotive shipments, causes above-average cyclical fluctuations in growth. Real GDP expanded by an average of just +2.2% over the past 20 years though the performance was better over the last five years prior to the Covid-19 pandemic (+4.1% on average, on par with the average of the Central and Eastern European EU member states and above the whole Emerging Europe average). As a consequence of the dependence on exports (accounting for around 90% of GDP), Hungary's economy was hit harder than others by the global Covid-19 crisis (-5.0% in 2020), despite strong economic policy support. Going forward, we expect a strong, broad-based recovery with annual growth of more than +7% in 2021 and around +4.5% in 2022. Consumer spending, fixed investment and net exports will be key drivers of the rebound.

Why invest in the Hungarian property market?

In general the property sector’s prime submarkets saw growth in rent levels thus decreasing vacancy ratios leading to increased investor appetite and transaction volumes. By investing in property, the highest returns can still be achieved in the CEE region. There is an increasing volume of investors eyeing the market and amongst the hotels the upscale/luxury sector is very much favoured. Improving the image and increasing the popularity of Budapest as a city-break destination. There are a number of seasoned destinations in provincial Hungary that could support the advent of new hotels and resorts. Tourism volume and hotel performance have shown a continuously increasing tendency since 2009 both in respect to Budapest and the countryside converging into solidly performing hotels year in year out. High investment appetite experienced for quality income generating products meets limited supply. Hungary is regarded as the fifth strongest health and medical destination in the world due to its excellent geographical location, outstanding quality of thermal waters and abundant geothermal resources. The country is a politically and economically safe destination. real INDUSTRIAL OVERVIEW

REAL ESTATE TRENDS

Real estate prices in Hungary have doubled in the last decade. In the European Union, only two other countries recorded greater price increases - Estonia and Luxembourg - according to Eurostat data. - Apartments in Budapest are getting more expensive - admits Gabor Borbely, director at CBRE. In his opinion, the reason for this is the fact that in Hungary flats and lots are still cheaper than in other European Union countries. If you compare them with what you have to pay for a similar flat or house in Warsaw or even in Prague, i.e. in cities where people have comparably the same amount of money and the geographic location is also comparable, Budapest is still 40-50 percent cheaper. Market prices start from 2.5k USD per square meter to 3.5k in the case of completely new apartments. There are also much more expensive offers for houses and apartments in the hills surrounding Budapest, near the castle, or in the very center with a view of the Danube, where sq. m prices start from 6.5k USD.

STATS & MORE

Real estate purchase worth

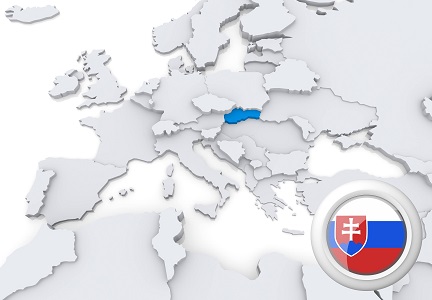

Slovakia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Slovakia

Slovakia is experiencing steady population growth, which is a positive indicator for potential real estate pricing trends. In recent years, the country's GDP growth has been healthy, and even during the pandemic, it remained strong, with a per capita income of over 19,000 USD annually. The unemployment rate has decreased significantly from 14% in 2013 to 5% in 2019, and inflation remains low, while the national debt is under control. As a member of the EU and NATO, Slovakia is located in the heart of central Europe, just 79 km from Vienna. The number of tourists visiting the country more than doubled between 2009 and 2019, indicating significant growth potential in the tourism sector.

Residence permits on the grounds of owning real estate

Slovakia has very few restrictions on foreigners buying properties, with the exception of agricultural land and forests. Both EU and non-EU citizens can buy properties in Slovakia without any restrictions. The buy-sell costs are relatively low, with a 20% VAT only applying to properties up to 5 years old, mainly new developments. For older properties, the costs are lower, with only a 2% legal registration fee and a low real estate agent fee. This makes buying property in Slovakia quite affordable for foreign buyers. Property prices in Slovakia have been steadily increasing at about 15% per year. Long-term rental yields are stable, but not very high, with an average growth of 4-4.5% per year.

Residence permits on the grounds of company formation

An investment of 150,000 EUR into your own or existing company will grant you the residency in Slovakia.

Taxes & Rental income tax

Slovakia offers a tax-friendly environment for property owners. There are no welfare taxes, inheritance taxes, local taxes, or property taxes. Rental income tax is calculated based on income, with a rate of 19% for income up to 35,000 EUR, and 25% for income above that amount. Property owners can deduct various expenses such as repairs, charges, and utilities from their rental income. Corporate tax is set at 21%, personal income tax at 25% (or 19%), and social security tax at nearly 50% (with companies paying 35.20% and employees paying 13.40%).

Dual nationality is allowed for most clients born overseas. However, if a person holds Slovakian citizenship along with another citizenship, Slovakian citizenship is dominant. Capital Gains Tax (CGT) for property is set between 19% and 25%, depending on the property value. If the property is not used for business purposes, there is no CGT.

Slovakia's tax policies create a favorable environment for property owners, with low taxes and the possibility of deductions to reduce tax liability.

Other residence types in Slovakia

Adoption, naturalization and others, such as student, employment, etc.

Which residence permits offer a path to permanent residency and citizenship?

Obtaining Slovakian citizenship offers a variety of benefits, including access to the Schengen Zone and visa-free travel to 189 countries, including Canada. There are several types of residence permits that can lead to citizenship, with the requirement being eight years of permanent residence in Slovakia prior to application. Applicants must have no criminal record, outstanding European arrest warrants, or deportation orders. Additionally, they must demonstrate knowledge of the Slovakian language and the country. In some cases, grants of citizenship may be given to individuals, such as those who get married to Slovakian citizens. Alternatively, individuals who have significantly contributed to Slovakia based on economical, technological, scientific, cultural, social, or sporting matters may be granted citizenship outside of the regular procedures, at the discretion of the government.

Restrictions & Challenges

While the rental yields in Slovakia are not exceptionally high, they are stable and reliable, and the country has a strong tradition of home-ownership. However, finding tenants for your property may require some time and effort. It's worth noting that the social security tax is relatively high, standing at almost 50% for employees. Additionally, it's important to consider that not knowing the Slovakian language can be a significant obstacle to obtaining citizenship and a passport. To apply for citizenship, you need to have at least 5 years of residency in Slovakia, and 8 years of permanent residency before you can submit your application.

LOCATION: Key location in the heart of Europe with great export potential

STABILITY: One of the safest and politically most stable countries in Europe

EUROZONE: A member of the Eurozone since 2009 as one of a few in CEE

QUALIFIED WORKFORCE: Cost–effective, skilled and loyal labour force with excellent multilingual skills

WORLD-CLASS PRODUCTIVITY: The highest labour productivity rate in the region (Eurostat)

INVESTOR-FRIENDLINESS: Continuously improving the competitiveness of the Slovak business environment (World Economic Forum)

INNOVATIVE ECOSYSTEM: The highest share of higher added-value jobs in CEE, ready for new investments into R&D and innovation (OECD)

GROWTH & BUSINESS ADVANTAGES

Slovakia's economy has performed strongly compared to both the Eurozone and emerging economies, but it has a high dependence on exports, particularly automotive shipments, which causes above-average cyclical fluctuations in growth. Over the past 20 years, real GDP has expanded by an average of 3.5%, which is above the average of Central and Eastern European EU member states and equal to the whole Emerging Europe average. However, due to the dependence on exports (which amounts to almost 100% of GDP), Slovakia's economy was hit harder by the global Covid-19 crisis than others, with a decline of 5.2% in 2020, despite significant economic policy support.

Going forward, a broad-based recovery is expected, with annual growth projected in the range of 4% to 5% in 2021-2022, driven by a rebound in both domestic and external demand. However, sustained or renewed supply-chain disruptions pose downside risks to these forecasts.

Slovakia's largest car producers are located in western Slovakia (Bratislava, Trnava, and near Žilina), making it the largest car producer per capita in the world. The British Jaguar Land Rover opened its plant near Nitra in 2018 and sees a significant opportunity for the development of the network of carmakers' subcontractors, particularly in the east of the country.

The electrotechnical industry is the second strongest pillar of Slovakia's economy, with companies located in Galanta, Nitra, Nové Mesto nad Váhom, among others. Other sectors with a tradition in Slovakia are the chemical industry and forestry.

IT is a promising sector in Slovakia, with strong IT clusters in Bratislava, Košice, and Žilina. Slovakia has also become home to several business service centers, most of which are currently located in Bratislava, with opportunities to expand into other parts of the country.

The trend of transitioning the economy towards services is evident through the growth of startups and R&D centers, many of which can utilize EU funds or the state's investment incentives. For potential investors, the automotive, electrotechnical, and IT industries offer the best opportunities for growth and investment in Slovakia.

REAL ESTATE TRENDS

According to the National Bank of Slovakia, the average price of dwellings in the first quarter of 2021 increased by 2.5% to 2179 EUR/m2, which is a growth of 54 EUR/m2 compared to the previous quarter. However, the annual growth rate decreased to 8.6%. The price of 4-room and 1-room apartments grew faster than 2- and 3-room apartments during the last quarter.

Meanwhile, the average price of houses and villas increased by 7.4% to 1471 EUR/m2, which is a growth of 102 EUR/m2 compared to the previous quarter. The annual growth rate for houses was 16.4%. The overall annual growth rate in residential real estate prices was mainly driven by the growth rate in apartment prices.

In the first quarter of 2021, the price difference per m2 between apartments and houses was 32.5%, which is lower than the average difference in prices for the whole year of 2020, which was 35.9%. The average price per m2 for both apartments and houses in Slovakia in the last quarter was around 1825 EUR/m2.

STATS & MORE

- Real estate purchase worth 250,000 EUR

- Foreign Direct Investment with 15,000 EUR threshold requirement

Croatia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Croatia

Croatia's property market is well-established and has demonstrated a stable growth rate, complemented by a consistent influx of tourists for around five months per year. The country is set to become a part of the Eurozone in 2023 and has recently eliminated work permit quotas, making it an even more attractive destination for businesses and investors. With a stunning coastline stretching 1,777.3 km and 1,246 islands and islets encompassing a further 4,058 km, Croatia's Adriatic Sea offers a unique experience for visitors, including the opportunity to see dolphins and enjoy world-class diving. Given its appeal to European vacationers, many of whom hail from Germany, Austria, and Poland, Croatia is sure to remain a top choice for years to come.

Residence permits on the grounds of owning real estate

If you own a property in Croatia and complete the necessary paperwork for residence, you can stay in the country for up to 9 months per year. However, it's important to note that this type of residence permit does not lead to permanent residency or citizenship in Croatia.

Residence permits on the grounds of company formation

Non-EU nationals looking to incorporate a company in Croatia must fulfill certain requirements. They need to hire three EU citizens or Croatians, including themselves, on a full-time basis and invest 200,000 Kuna (approximately $30,000 USD) in startup capital. During the incorporation stage, the shareholder must physically relocate to Croatia and provide proof of a local address; otherwise, the court may reject the application. Additionally, paying state health insurance and relevant taxes is mandatory.

If the company's primary business is renting out apartments, it will be subject to a state tax of 10% and a locally determined Company Income Tax, which varies from place to place. For instance, the tax paid in Dubrovnik may differ from that paid in Split. The Capital Gains Tax is 25% if you sell your property within three years of acquiring it; after the three-year threshold period, it drops to 0%.

Officially, there are no retirement residence permits, but with the assistance of a competent lawyer, this type of residence can also be arranged. Obtaining permanent residency (after holding qualifying temporary residence types for five years) requires a language test, which foreigners generally do not find particularly challenging.

Other residence types in Croatia

There are several residence options available for non-EU nationals in Croatia. These include options for work, volunteering, student programs, property ownership, scientific research, and other purposes. A relatively new option is the digital nomad visa, which offers tax exemptions for individuals who work remotely for an overseas company.

Regardless of the option chosen, applicants may need to provide a range of documents, such as proof of a 12-month property lease, evidence of wealth in their bank accounts, criminal records, and a clear explanation of the purpose of their stay. All documents must be translated and apostilled before being submitted to the local police station.

It's worth noting that although there is no official retirement visa in Croatia, a skilled lawyer can potentially help retirees to obtain residency through other means. Additionally, those who hold a qualifying temporary residence permit for 5 years can apply for permanent residency, which requires passing a language test that is not considered particularly challenging by most foreigners.

Which residence permits offer a path to permanent residency and citizenship?

If you are a non-EU national, there are two main ways to obtain citizenship in Croatia: being hired by a Croatian company with a proper labor contract or becoming an entrepreneur and forming a local company. Additionally, it's worth noting that marrying a Croatian citizen can also lead to citizenship. However, keep in mind that these options may take several years to complete and may require meeting certain requirements and passing various tests.

Restrictions & Challenges

Individuals from certain countries may face restrictions on buying properties in Croatia. To rent out an apartment, setting up a company is necessary, which is subject to a state tax of 10% and locally determined Company Income Tax that varies from place to place (tax rates in Dubrovnik may differ from those in Pula). Capital Gains Tax is 25% if the property is sold within 3 years of acquisition, but it is 0% after the 3-year threshold period. Officially, there are no retirement residence permits in Croatia, but a skilled lawyer may be able to assist in obtaining this type of residence. To obtain permanent residency (after holding qualifying temporary residence types for 5 years), a language test must be taken, which foreigners do not consider particularly difficult.

Business-oriented environment, an efficient, innovative, highly qualified and multilingual workforce, cost competitiveness, an exceptionally favourable geostrategic position, attractive incentives as well as professional and free services provided to investors are just some of the reasons to invest in Croatia.

GROWTH & BUSINESS ADVANTAGES

Croatia's tourism industry, which contributed to 25.1% of the country's economy in 2019, experienced a significant setback due to the COVID-19 pandemic. While the summer season of 2021 showed promising signs of recovery, the overall tourism numbers for the year were still substantially lower than 2019. In particular, Dubrovnik suffered from a significant drop in tourist numbers and has now shifted its focus to address over-tourism, local habitability, and sustainable tourism measures.

In 2019, Croatia achieved a record high in tourist visits and spending, with 19.6 million tourist arrivals and 91.24 million tourist nights. However, the pandemic caused a 64.2% drop in tourist arrivals and a 55.3% drop in tourist nights in 2020, with only 7.0 million arrivals and 40.8 million tourist nights.

Despite a slow reduction in COVID-19 cases and a rapid vaccine rollout, travel restrictions and safe capacity limits still exist. As of September 2021, there were only 9.0 million tourist arrivals and 55.3 million tourist nights realized, which is still significantly lower than 2019.

Nevertheless, Croatia is a modern economy that can quickly adapt to challenges and is popular among foreign investors due to its ease of doing business, excellent investment incentives, well-prepared institutional infrastructure, competitive workforce, and quality of life. Many foreign companies, including multinational corporations like IBM, Microsoft, Oracle, Coca-Cola, Teva, Siemens, and Ericsson, have recognized Croatia's advantages. Moreover, the government provides strong institutional support for sustainable development and new technologies, making it a desirable destination for foreign investors.

Foreign investors can establish companies in Croatia and acquire property without any restrictions, provided they satisfy the condition of reciprocity. Additionally, foreign investors are guaranteed free transfer and repatriation of profits and invested capital, and they have the same rights and obligations as domestic investors. However, non-EU citizens and legal entities face restrictions when acquiring ownership of certain types of real estate in Croatia.

REAL ESTATE TRENDS

If you're considering buying real estate in Croatia, it's better not to wait. With Croatia adopting euro, we expect a significant appreciation against minor currencies such as the Polish zloty and the euro. This will not only make holidays in this popular destination relatively more expensive, but also real estate," says David Katrenčík, Marketing Manager and Real Estate Broker at Rellox.

He adds, "For example, during Slovakia's transition to the euro between 2005-2009, their currency strengthened against the euro by more than 20 percent. Therefore, investors should not hesitate to buy relatively cheap real estate in Croatia now."

So, how much do you need to buy a property on the Adriatic Sea? "The prices of real estate vary depending on the location, type, area, and services offered. However, the vast majority of properties in our offer are in the range of 2,000 to 5,000 euro/m2," explains David Katrenčík.

STATS & MORE

Company formation - €150,000*

Estonia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Estonia

Estonia boasts a powerful passport that ranks 11th in the world, granting its citizens visa-free access to 179 countries and territories, including the United States, Canada, Australia, and New Zealand. Estonia has been a long-standing member of the Eurozone, and its business climate is known for its transparency, efficiency, and favorable tax policies. In recent years, Estonia has experienced rapid economic growth, with a strong emphasis on technology and innovation. Estonia's business landscape is strongly influenced by its Nordic neighbors, fostering a collaborative and forward-thinking environment for entrepreneurs and investors alike.

Residence permits on the grounds of owning real estate

Residence permits based on real estate ownership are available in some countries, but it's important to note that simply owning property does not guarantee a residency permit. In some cases, real estate can be considered an asset belonging to the company you set up, which may open up residency options. However, it's important to research the specific requirements and regulations of each country before pursuing this option.

Residence permits on the grounds of company formation

Estonia's residency by investment program is considered to be one of the best in the world. It offers reasonable conditions for entrepreneurs who wish to invest in existing companies, set up their own business or operate as sole proprietors. To be eligible for a residence permit through this program, the minimum investment required is 65,000 EUR. However, if you are a self-employed individual, only 16,000 EUR is sufficient. The investment amount can include fixed assets and the capital of your company, and your application will be evaluated based on a carefully prepared business plan.

Estonia also offers a digital nomad visa for those who work remotely for their own company and can prove a steady income from providing services to other companies. To be accepted to this scheme, a minimum income of around 3,500 EUR per month (in the 6-month period prior to the application) is required. This type of visa can be applied for through the embassies. Additionally, Estonia has a separate E-Residency program that allows entrepreneurs to establish and manage an EU-based company entirely online. Contact Lee & Bronski for more information on the E-Residency Program.

Taxes & Rental income tax

Estonia is known for its unique tax system that taxes worldwide income. The income tax rate is calculated on a monthly basis and is based on distributed profits. Corporate Income Tax (CIT) is generally a flat rate of 20%. Additionally, dividends are taxed at a rate of 14%.

Which residence permits offer a path to permanent residency and citizenship?

To clarify, the residence permits that offer a path to permanent residency and citizenship in Estonia are as follows:

-

Working: If you hold a valid work permit and reside in Estonia continuously for five years, you may be eligible to apply for permanent residency. After holding permanent residency for five years, you may be eligible to apply for citizenship.

-

Studying: If you are a student in Estonia, you may be eligible to apply for a temporary residence permit. After holding a temporary residence permit for five years, you may be eligible to apply for permanent residency. After holding permanent residency for five years, you may be eligible to apply for citizenship.

-

Marriage: If you are married to an Estonian citizen or a permanent resident of Estonia, you may be eligible to apply for a temporary residence permit. After holding a temporary residence permit for five years, you may be eligible to apply for permanent residency. After holding permanent residency for five years, you may be eligible to apply for citizenship.

Regarding talent residence permits, individuals who are granted a talent residence permit and fulfill certain conditions may be eligible to apply for permanent residency after just one year of residence. After holding permanent residency for five years, they may be eligible to apply for citizenship.

It's worth noting that the requirements and eligibility criteria for each type of residence permit may vary, and it's important to consult with Estonian authorities or a Lee & Bronski's professional guides for detailed information.

Restrictions & Challenges

Estonia follows a policy of not allowing dual citizenship, which means that individuals must renounce their existing citizenship upon acquiring Estonian citizenship. In order to be eligible for Estonian citizenship, applicants are required to pass a language test.

Estonia consistently ranks as a world leader in human capital, digital capability, and ease of doing business. This creates a competitive environment which allows solutions and services to be researched, developed and delivered globally. From multinational companies to high growth startups, Estonia has a two-decade track record of successful investments and innovations.

GROWTH & BUSINESS ADVANTAGES

Estonia is a Northern European hub for Industrial, Supply Chain and GBS activity and a world leader in IT. As IT becomes the value driver across all industries, Estonia is uniquely positioned as the scalable location of choice for knowledge and digital business.

IT / R&D / software

Estonia is the world’s most digitally enabled nation, offering a unique combination of talent, environment, and innovation. Our IT R&D ecosystem enjoys global proof of concept, being trusted by global organisations such as Kuehne+Nagel and NATO and producing unicorn startups like Wise and Bolt.

Fintech

Estonia is a cashless society with over 99% of financial transactions occurring digitally. Electronic ID and Blockchain are widely used in FinTech applications. 80+ FinTechs ranging from innovative startups such as Wise to Blockchain leader Guardtime make Estonia a global centre of excellence for FinTech.

Cyber security

The most advanced cyber security country in Europe, Estonia has unique expertise in the research, development and management of cyber security solutions and systems. Home to NATO CCDCOE, Guardtime and Malwarebytes, Estonia is trusted to keep the digital economy safe.

Blockchain economy

Estonia developed X-Road, its proprietary decentralised, distributed system in 2001 and has utilised Blockchain since 2008. World-class technical skills supported by practical experience implementing public and permissioned Blockchain’s place Estonia at the forefront of the emerging Blockchain economy.

Swedbank has raised its forecast for Estonia's economic growth this year by 5 percentage points to 8 percent, up from 3 percent in the spring.

An economic growth of 8 percent would represent the highest growth for the past 15 years.

Swedbank said it raised its forecast for this year, as GDP growth in the first quarter of the year was stronger than previously expected.

"This sharp jump in growth provided additional momentum also for the rest of the year. This year's economic growth is going to be broad-based, driven by strong private consumption, investment and exports," Tonu Mertsina, chief economist at Swedbank Estonia, said at the presentation of the economic forecast.

Next year, however, gross domestic product (GDP) growth is expected to slow to 5 percent, according to Swedbank's latest Economic Outlook. In April, the bank expected growth of 4.3 percent in 2022.

The GDP growth forecast for 2023 by Swedbank is 3.2 percent.

The Swedbank Estonia chief economist said that the Estonian economy has quickly emerged from last year's recession. In particular, Estonia's GDP growth in the first quarter was one of the fastest among the countries of the European Union (EU), and the strong recovery of the economy continued in the second quarter.

Overall confidence in the economic sectors meanwhile has risen to its highest level in 14 years. The production volume of the manufacturing industry in June was close to its peak registered two years ago, and the growth in the sales volume of retail companies rose to double digits in the second quarter. Mertsina said that expectations for industrial growth and demand in the services sector are high for the near term.

REAL ESTATE TRENDS

After the first lockdown, many so-called real estate experts predicted a decline in housing prices. However, a year later, it became clear that not only had prices not dropped, but they had actually increased. What's more, in many EU countries, housing prices have risen faster than salaries, which is cause for concern. Over the past decade, real estate prices in Hungary have increased by 90.6%, while in Austria they've gone up by 81.4%. Yet, the European countries that have seen the highest increase in real estate prices are Luxembourg and Estonia, where they've gone up by 99.8% and 112.8%, respectively. Despite the crisis, the real estate market has remained very active, as interest in buying has been supported by wage increases in most sectors of the economy and by rapid growth in household deposits. At present, Eesti Pank doesn't see any major problems in the real estate market. However, going forward, the risks of real estate prices rising rapidly will increase as Covid-19 is brought under control and restrictions are lifted. As people become more confident, borrowing remains cheap due to central bank monetary policy, banks want to lend on good terms, and more than a billion euros will be taken out of the second pension pillar in the autumn, prices could rise rapidly due to a combination of these factors.

STATS & MORE

By investment 65,000 EUR

By setting up sole proprietorship - 16,000 EUR

Latvia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Latvia

- Visa free travel into 179 countries, including US and Canada.

- Long standing partner of NATO, the EU, the EUR Zone Schengen since accession.

- GDP per capita of Latvia is 18,000 USD per year.

While property prices in Latvia are still below 1,000 EUR, new properties in the capital city can cost anywhere from 2,000 to 7,000 EUR/m2. Yields are not particularly high, averaging around 4%, but investing in Riga's Old Town may bring in annual yields of 6-7%.

Despite the pandemic, Latvia's GDP has remained stable and the country's economy is performing well. In fact, it only dropped by 3.5%, which is much better than most West-European countries. Over the last few years, salaries have increased from 600 to 860 EUR.

National debt in Latvia is around 50% of GDP, and tourist numbers are growing steadily. The process of buying real estate in Latvia is simple and regulated, making it a fast process for potential buyers.

Residence permits on the grounds of owning real estate

To obtain a residence permit through investment in Latvian properties, an investment of at least 250,000 EUR is required. It's important to note that agricultural land, woods, and forests cannot be purchased for this purpose. Additionally, each property acquired must be valued at a minimum of 80,000 EUR, with a 5% state tax and a 2% state duty added. Dependents such as spouses, minor children, and parents can also be granted residence permits.

The residence permit is initially granted for a period of 5 years, and must be renewed annually thereafter.

Residence permits on the grounds of company formation

Obtaining a residence permit through company formation is not recommended for taxation reasons, especially if you are already applying for a residence permit through property purchase.

Taxes & Rental income tax

Dual citizenship is allowed, but global income is subject to taxation. The personal income tax rate is 31%, the corporate income tax rate is 20%, and the value-added tax (VAT) is 20%. Social security tax is 35.09%, and taxes are levied on worldwide income.

The cost of purchasing real estate is relatively low, with affordable buy-sell costs. New builds are subject to a 21% VAT, while older buildings incur a 2% stamp duty and 0.5% notary fee. The sales party pays a 3% tax.

There are no inheritance, city, or wealth taxes, and capital gains tax (CGT) rates range from 20% (up to 20,004 EUR) to 31% (above 64,000 EUR), with generous deductions allowed. Alternatively, a flat fee tax of 10% is available, with no deductions.

Property taxes are higher than in Lithuania or Estonia, but lower than in Western Europe.

Which residence permits offer a path to permanent residency and citizenship?

To clarify, in Latvia, you can apply for citizenship after holding a permanent residence permit for five years, but you are required to have actually resided in the country for a total of at least ten years. The residence permits that can lead to permanent residency and citizenship in Latvia include, but are not limited to, employment, studies, investment, family reunification, and refugee status.

Restrictions & Challenges

- A 21% VAT rate is applied to new builds in Latvia's real estate market.

- The population of Riga and Latvia has been decreasing, which may not be a positive indicator for investing in the real estate market. This trend is different from the other Baltic capitals of Vilnius and Tallinn.

- Foreign buyers account for up to 70% of real estate purchases in Riga, which may pose a risk of market depression if they liquidate their investments.

- Latvia's unemployment rate is relatively high.

Latvian ecosystem is small, yet vibrant, it consists of highly motivated multilingual (often with at least 3 languages or more) talented people of various age and backgrounds. The startup environment is dynamic and rapidly growing. To nurture this growth, all important stakeholders have joined hands together.

Latvian startup infrastructure consists of 400+ registered startups, a pool of institutional investors and business angels, a diverse range of modern co-working spaces, dozens of business incubators fuelled by the government, academia and private individuals, as well as full of exciting gatherings, productive conferences, hackathons and meetups. The capital city Riga hosts numerous annual Tech & Innovation conferences: the iNovuss, Deep Tech Atelier, Riga Tech Girls, TechChill and others. Moreover, a unique Startup Law has been passed and Startup Visa, officially - temporary residence permit, has been created in order to make Latvian startup ecosystem even more vibrant and productive.

GROWTH & BUSINESS ADVANTAGES

As European Union is starting to get back on track after the pandemic and economic forecast by European Commission is also becoming more optimistic. Latvian indicators in this forecast are not the exception. In this briefing, figures provided by the EC Spring 2021 Economic Forecast are analysed. Also, the financial sector is playing a big role in the recovery of the country after the pandemic, so understanding the trajectory of its development is essential. Considering that the financial sector in Latvia is one of the most developed areas in the country, the issue of faster and more efficient improvement remains even more acute.

The Latvian economy will grow by 3.5% this year (GDP growth) and consumption are going to return to the pre-Covid level, additional stimulus to the economy will be provided by an increase in investment, including due to a significant inflow of European Union (EU) funding.[ii] In 2021 Latvia’s state support for entrepreneurs and households has significantly increased compared to 2020, while the state budget deficit is growing accordingly. The budget deficit reached 4.5% of the GDP in 2020, but this year it is already forecasted at 7.3%. In turn, the EC forecasts that next year the Latvian GDP will grow by 6% and the budget deficit will be reduced to 2%.

Consumer price inflation was lowered in 2020, displaying decreasing energy prices and low service prices, because of the low demand. More expensive energy and service prices over the projection period are set to raise headline inflation to 1,7% in the current year and 2% in 2022.

Latvian government has particular interest and determination in boosting the development of startup environment, therefore, the support is provided at various stages: ideation & conceptualization, initiation, development and expansion. No matter what stage you have reached – there is a support mechanism just for you! And it is implemented and delivered through Magnetic Latvia Startup.

Startup Law

The Law creates a favorable tax regime for startups. The law foresees two benefit scenarios: 1) a special flat tax regime, currently 340,90 euros/month per employee, regardless of salary paid, combined with the 0% individual income tax rate, or 2) 45% co-financing for the highly qualified specialists.

Startup Visa

Startup visa, officially - a temporary residence permit, is offered to all non-EU startup founders who are willing to come and develop their startup ideas in Latvia. One startup can have up to 5 founders with a startup visa. The application process takes one month. The visa is given for the period of maximum 3 years and it is also issued to the spouse and children.

Innovation Vouchers

Innovation voucher program is aimed for any-size businesses that develop new products or technologies. The R&D actions supported by the program are the development of a new product or technology, the strengthening of industrial property rights and the certification and testing of new product or technology. Innovation vouchers are up to 85% co-financed in the amount of 25 000 EUR.

Science Commercialization

The Investment and Development Agency of Latvia provides support to public research organizations for commercialization of research results. Among supported activities are: carrying out a feasibility study, preparation of a commercialization strategy, industrial research, experimental development, participation in international exhibitions, contact exchanges, conferences (seminars) abroad, individual visits and participation in national booths and trade missions, preparation of commercialization offers, attraction of experts and other activities.

Business Incubators

There are 13 LIAA incubators throughout the whole Latvia that support the necessary environment for the set up and development of business by offering training, mentor support and grants, and organizing events on general business issues.

Acceleration Funds

In 2017, the government made a special EUR 15 million acceleration fund (allocated by the European Regional Development Fund during the planning period of EU structural funds 2014-2020) available through ALTUM to support Latvia-based early-stage startups. The fund was then equally divided after a public procurement between three professional funds: Buildit focusing on hardware and the internet of things startups, Commercialization Reactor focusing on deep-tech startups, Overkill Ventures focusing on B2B software startups. There is one more acceleration fund in Latvia - Startup Wise Guys, focusing on B2B Fintech startups.

REAL ESTATE TRENDS

The Latvian real estate market has experienced a significant drop in prices for top-tier properties, largely due to a decrease in Russian buyers. Previously, Latvia was a popular destination for Russians seeking real estate investments, with a quarter of the country's population being ethnic Russians. However, changes to residency laws have made it more difficult for Russians to invest in Latvia, leading to a decrease in demand for luxury properties in the capital, Riga, and the coastal town of Jurmala. Russian oligarchs, politicians, entrepreneurs, and mafiosi were among those who invested big money in luxury real estate in Jurmala, but the market has now slowed down considerably. Although Russian clients still view properties, transactions are very rare, leading to a drop in prices by 20-30% for top-tier properties. The Financial Times reports that demand for real estate has dropped by 90%, and it is unclear whether bargain purchases will become available on the market or whether Russian demand for luxury real estate will rebound.

STATS & MORE

By acquiring a property of >250,000 worth

Lithuania

PROPERTIES & RESIDENCE

Consider the benefits of investing in real estate in Lithuania

The Vilnius real estate market offers reasonable prices, with an average rate of 1,700 EUR per square meter. While new apartments in the Old Town and city center may be more expensive, ranging from 3,000 to 5,000 EUR per sq/m, prices outside of the city center are much more affordable, ranging from 1,700 to 2,200 EUR per m2.

The potential yield is around 6%, and buy-sell costs are exceptionally low, with the exception of new builds where the hefty 21% VAT is added. Notary and registration fees amount to less than 5%, while seller fees are around 3%.

Lithuania has shown excellent GDP growth, as proven by the fact that even during the pandemic, the economy only dropped by 0.8%. In comparison, the UK's GDP dropped by 9.9% in 2020. Furthermore, employment conditions have significantly improved, dropping from 17.8% in 2010 to just 6% in 2020.

Salary growth in Lithuania, similar to Latvia, has seen annual growth rates of between 5% and 15% in the past five years, with salaries rising from 500 EUR per month to 916 EUR per month in the past six years. Although the government debt grew during the pandemic, it only increased by 48%, compared to over 100% in the UK.

The fintech industry in Lithuania has benefited greatly from foreign investments, and the country is home to successful startups like Revolut.

Lithuania has a highly educated population, with 125,000 students in a country with a relatively low population. Additionally, tourism in Lithuania is on the rise, and the population is steady. These factors make Lithuania an attractive destination for property investment.

Residence permits on the grounds of company formation

If you are interested in obtaining a residence permit in Lithuania by forming a company, it is important to keep in mind that the requirements and options can change frequently. Contact Lee & Bronski Support to stay up-to-date on the latest information.

Currently, one option is to apply for a residence permit after six months of setting up a company. To do so, you must establish a company with a share capital of at least 29,000 EUR and employ three Lithuanian citizens or workers with residency permits.

If you want to obtain permanent residency, you must live in Lithuania for five years as a temporary resident.

Taxes & Rental income tax

Capital Gains Tax in Lithuania is set at 15%. Rental income is also taxed at 15%, with deductions of 30% allowed. However, if you receive over 163,000 EUR in rental income in a year, an additional 20% tax may apply. The good news is that there is no gift tax or inheritance tax in Lithuania. In terms of property tax, properties worth up to 150,000 EUR are exempt from property tax. Properties valued between 150,000 EUR and 300,000 EUR are subject to a 0.5% property tax, while properties worth between 300,000 EUR and 500,000 EUR are taxed at a rate of 1%. If your property is valued at 0.5 million EUR or more, you can expect to be charged a 2% property tax rate.

Other residence types in Lithuania

There are various other types of residence permits that you may be eligible for depending on your circumstances. These include permits based on factors such as education, marriage, and naturalization, among others. It is recommended to consult with a legal professional or immigration specialist to determine which type of residence permit is best suited to your situation.

Which residence permits offer a path to permanent residency and citizenship?

The Lithuanian passport is highly desirable as it provides visa-free access to 180 countries and territories, making it the 9th most powerful passport in the world. If you have lived in Lithuania for 10 years, you may be eligible to apply for citizenship, although you will need to pass a Lithuanian language test. In some cases, Lee & Bronski may be able to assist you in obtaining Lithuanian citizenship without fulfilling the standard requirements.

Restrictions & Challenges

While rental yields in Lithuania may not be exceptional, they are on the rise.

Tourism aside, the US companies are increasingly keen to explore other mature but less saturated locations for the GBS & ICT sector. Similarily, the Financial Services and Research sectors currently comprise the largest employee base of the Lithuanian GBS ecosystem. The Information Technology and Services sector continues to be a leader with 41% of all Business Services Centres in Lithuania.

GROWTH & BUSINESS ADVANTAGES

The Lithuanian economy has shown remarkable growth during the pandemic, with the release of economic performance results in July indicating an unprecedented 8.6% rise in GDP growth in the second quarter compared to the same period last year. Economists note that the economy has not only recovered, but has effectively returned to pre-global financial crisis levels in 2008. This current growth is a balanced expansion driven by moderate public debt, increased production and exports, raising salaries, and domestic consumption, unlike the precipitous growth seen over a decade ago. Despite restrictions on global commerce and trade during the pandemic, the economy has demonstrated resilience. Analysts predict that the economy is on a sustainable track, with annual GDP growth expected to continue at 4-5%. The Lithuanian government emphasizes creating new jobs and supporting businesses that plan to grow using Lithuanian specialists or export products. To facilitate this, the government has launched a start-up visa for innovative entrepreneurs from other countries wishing to establish a start-up in Lithuania. The program no longer requires fulfillment of certain capital or employment requirements to obtain a residence permit. If a business idea is approved by a panel of experts, it forms the basis to apply for a temporary residence permit. In conclusion, Lithuania offers a convenient and inexpensive jurisdiction for registering a company and conducting business with excellent development prospects. Lithuanian companies are popular due to their low costs of accounting and administration, low taxes, and strategic geographical position. Moreover, Lithuania is an attractive destination for foreign entrepreneurs due to its stable, business-oriented government, multilingual communication capabilities, agreements on avoiding double taxation, relatively inexpensive labor, low price level, and absence of exchange controls. Lithuania ranks among the world's freest economies in terms of ease of starting a business and is also one of the leaders in Europe in terms of investment attractiveness.

REAL ESTATE TRENDS

The primary markets for new construction apartments in Lithuania are its major cities, namely Vilnius, Kaunas, and Klaipėda. However, the coastal region emerged as the clear winner of the housing market in 2020 due to travel restrictions and limited mobility within the country. Many people chose to invest in seaside properties during this time. In contrast, the individual residential houses and land plots in the major cities and their districts were relatively active, but not as successful as the coastal market. Nevertheless, they fared better than the urban apartment market and even experienced growth during the pandemic.

STATS & MORE

Company formation with €29,000 capital*

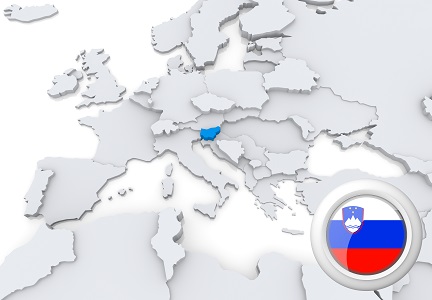

Slovenia

PROPERTIES & RESIDENCE

Advantages of obtaining a property in Slovenia

Slovenia has a GDP per capita of 26,000 EUR, making it one of the wealthiest countries in the region. Additionally, holders of Slovenian passports have visa-free access to over 180 countries.

Residence permits on the grounds of owning real estate

A person can obtain a residence permit by investing 7,500 EUR in a company, which is then used to purchase a property worth 50,000 EUR. Once the company has invested in the property, the person can apply for a residence permit. The total investment required for this pathway is 60,000 EUR. It is important to note that specific requirements and regulations may vary depending on the country in question.

Residence permits on the grounds of company formation

It is important to clarify that the information provided is not entirely accurate. In general, in order to apply for a residence permit on the basis of business investment and setting up a company, the applicant needs to invest a certain amount of capital in the company, which varies depending on the country. The amount mentioned, 7,500 EUR, may apply to a specific country, but it is not a general rule.

Additionally, it is not common or necessary for the applicant to get hired by their own company in order to apply for a residence permit. The main requirement is usually to demonstrate that the investment made will have a positive impact on the country's economy, and that the applicant has the necessary skills and experience to run the business.

It is important to thoroughly research the specific requirements and procedures for obtaining a residence permit through business investment and setting up a company in the country of interest.

Taxes & Rental Income Tax

Slovenia has a relatively heavy tax burden compared to some other countries, with a corporate income tax rate of 19% and a personal income tax rate of 15%. In addition, the sales tax rate in Slovenia is 20%, and social security taxes can be as high as 38%. Rental income is also taxed in Slovenia, with the option to choose between paying 10% of gross income or 15% of net income. It is important to note that taxpayers can deduct certain costs associated with rental income for tax purposes.

Also, to add some more details on rental income tax in Slovenia, it's worth noting that the tax rate depends on the type of property and the length of the rental period. For short-term rentals (less than 30 days), the tax rate is 25% of the gross rental income, while for long-term rentals (30 days or more), the tax rate can be either 10% of the gross rental income or 15% of the net rental income.

In addition, it's possible to deduct certain expenses related to the rental property, such as repairs and maintenance, property management fees, and insurance premiums. The tax authorities may require proof of these expenses, so it's important to keep proper records.

Other residence types in Slovenia

In addition to the business investment and ownership of real estate, there are other types of residence permits available in Slovenia, including:

-

Employment: Non-EU citizens can obtain a residence permit for the purpose of employment in Slovenia. The employer must provide a job offer, and the employee must meet certain qualifications and language requirements.

-

Studies: Students from outside the EU can obtain a residence permit for the purpose of studying in Slovenia. They must provide proof of enrollment in a recognized educational institution and have sufficient financial means to support themselves during their studies.

-